The latest data released by the Reserve Bank of India (RBI) has sent a clear signal to the Indian job market that the traditional dominance of private sector banks as massive engines of employment is undergoing a significant shift. For the fiscal year 2025, the banking landscape has revealed a surprising trend where private sector giants are trimming their workforces, while smaller players and public sector institutions are showing unexpected resilience in their hiring patterns.

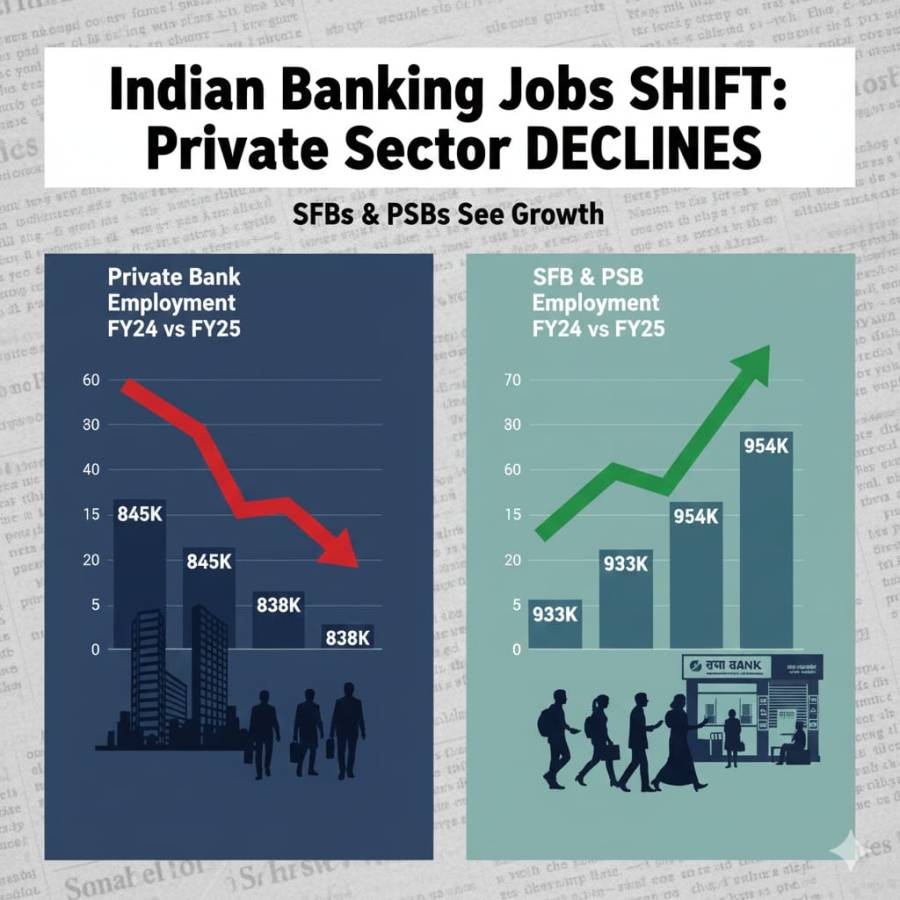

According to the RBI figures, the total headcount within the private banking sector saw a noticeable dip. Specifically, the number of employees fell to 838,150 in FY25, down from 845,407 in the previous fiscal year. While a drop of roughly 7,000 employees might seem minor in a country of over a billion people, it marks a pivotal departure from the aggressive expansion strategies that defined the last decade of private banking in India.

One of the most striking examples of this contraction is ICICI Bank, India’s second-largest private lender. The bank saw a sharp decline in its staff strength, moving from 141,009 employees in FY24 to 130,957 in FY25. This reduction of over 10,000 roles in a single year highlights a broader push toward operational efficiency and, likely, the increasing role of digital automation in handling routine banking tasks. Even HDFC Bank, which did see an increase, only grew its base marginally to 214,521 from 213,527, suggesting a very cautious approach to adding new human capital.

Interestingly, the overall banking system in India actually saw a net increase in employees, reaching 1.808 million up from 1.787 million. If private banks are cutting back, where is this growth coming from? The answer lies in two areas: Public Sector Banks (PSBs) and Small Finance Banks (SFBs).

Public sector banks, often criticized for being slower than their private counterparts, actually saw their numbers rise to 757,641 from 756,015. While the growth is modest, it represents a stabilizing force in the job market. State Bank of India (SBI), the nation's largest lender, led this charge by increasing its total employee count to 236,226.

However, the real "hiring heroes" of the year were the Small Finance Banks. These institutions added nearly 16,000 employees to their rolls, bringing their total workforce to 177,000. AU Small Finance Bank has emerged as a major player in this space, now boasting a staff base of over 50,000 people. This suggests that while "Big Banking" is consolidating and automating, the "last-mile" banking services—which require more human interaction and local presence—are where the new jobs are being created.

This shift tells us a lot about the future of work in Indian finance. The decline in private sector roles suggests that the era of massive "back-office" hiring might be coming to an end as AI and digital platforms take over processing and administrative duties. On the other hand, the growth in SFBs indicates that there is still a massive demand for banking in rural and semi-urban areas where a human touch is essential for financial inclusion.

For job seekers and industry analysts, this is obvious and natural. The banking sector isn't shrinking, but it is evolving. The high-growth opportunities are migrating away from the traditional private headquarters in Tier-1 cities toward specialized lenders and public institutions that are still focused on expanding their physical footprint. As we move deeper into 2025, the ability to adapt to digital tools while maintaining the personal touch required by Small Finance Banks will likely be the key to a successful career in Indian banking.