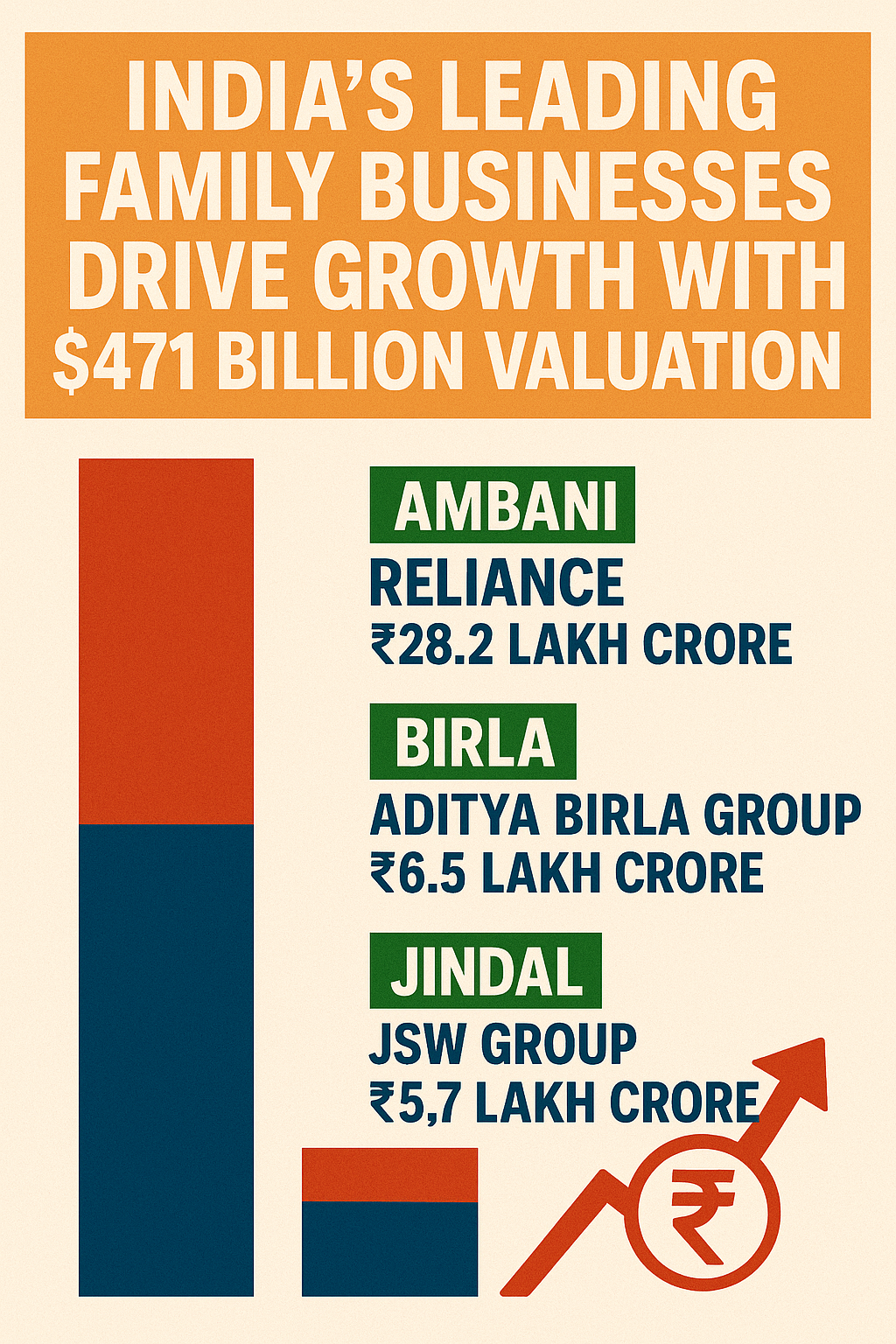

India’s family-owned businesses play a major role in the country’s economy, creating jobs, contributing to taxes and enhancing industrial growth. According to the Barclays Private Clients Hurun India Most Valuable Family Businesses list, the top three families together have a valuation of 471 billion US dollars. The report released on Tuesday (June 12, 2025) highlights how these multi-generational enterprises have built strong industrial and financial power over the years.

The Ambani family continues to dominate the list. With a valuation of ₹28.2 lakh crore, Reliance Industries led by Mukesh Ambani remains the largest family-owned business in India. The company operates in sectors such as petrochemicals, retail, telecommunications and green energy, making it a significant contributor to the national economy.

The second position is held by Kumar Mangalam Birla’s family, which manages the Aditya Birla Group. Their valuation stands at ₹6.5 lakh crore. The group is active in diverse areas such as metals, cement, textiles, telecom and financial services.

The third position goes to the Sajjan Jindal-led Jindal family of JSW Group. With a valuation of ₹5.7 lakh crore, the group has a strong presence in steel, energy, infrastructure and cement. Together, these three families account for a major share of India’s total family business wealth.

The Hurun report also states that the expanded list includes 300 families whose combined worth is about 1.6 trillion US dollars, which is around ₹134 lakh crore. These businesses employ more than 2 million people across India. This employment figure is greater than the population of many small countries. The report also points out that these companies contributed ₹1.8 lakh crore in taxes last year, forming nearly 15 percent of India’s corporate tax collections. On an average day, these enterprises generate ₹7,100 crore in revenue.

The top 10 families alone make up nearly half of the total valuation of the list. Apart from the Ambanis, Birlas and Jindals, other leading names include the Bajaj family of Bajaj Group, the Mahindra family of Mahindra & Mahindra, the Nadar family of HCL Technologies, the Murugappa family of Cholamandalam Investment & Finance, Wipro’s Premji family and Anil Agarwal’s Vedanta. The list also features the Dani-Choksi-Vakil families who jointly manage Asian Paints, as well as the Agarwal family operating Hindustan Zinc.

From an industry perspective, companies making industrial products form the largest segment with 48 entries in the list. The automobile and auto components sector has the highest average valuation of around ₹52,320 crore per company. Pharmaceuticals remain another strong segment with 25 leading family-owned businesses, each having an average valuation of over ₹41,000 crore.

Anas Rahman Junaid, founder and chief researcher of Hurun India, explained that the variety of sectors represented in the list shows how family businesses contribute to industrial progress. He highlighted that these enterprises not only strengthen India’s global competitiveness but also help in building economic resilience. Most of these companies are publicly listed, which shows a trend towards greater transparency and better corporate governance. Out of the 300, about 222 companies are listed on stock exchanges while 78 remain privately held.

The Hurun report makes it clear that family-owned businesses are not just part of India’s tradition but also a driving force for the country’s future. They create jobs for millions, contribute significantly to tax revenues, diversify into multiple industries and set examples of long-term business planning. Their ability to maintain and grow wealth over generations reflects their strong leadership, adaptability to market changes and commitment to professional management.

By continuing to innovate and expand, these families are likely to remain key players in India’s economic development for years to come. Their presence in global markets and consistent performance also project India as a strong industrial and commercial power on the world stage.