In a nation where revolutions often make headlines, some unfold quietly—on paper, muted, methodical, and monumental. The latest data from the Income Tax Department does not cry out in bold slogans, yet it silently documents a fundamental transformation. For the second year in a row, more women than men have secured PANs (Permanent Account Numbers), marking a shift from symbolic empowerment to statistical assertion.

In FY25 alone, 29.1 million PANs were issued to women, over 23% more than those issued to men. This wasn’t a ripple; it was a current. It didn’t erupt in protest but emerged through participation. For a country like India—long defined by patriarchal hierarchies and inherited invisibilities, these numbers are more than administrative; they are historic.

A PAN, after all, is more than a number. It is a credential of financial identity. It offers access to tax systems, investments, loans, and the labyrinthine world of formal economics. Until recently, it was a world women entered cautiously, often through the signature of a father, husband, or son. That shadow is receding. Along with it, the gendered silence surrounding money is beginning to dissolve.

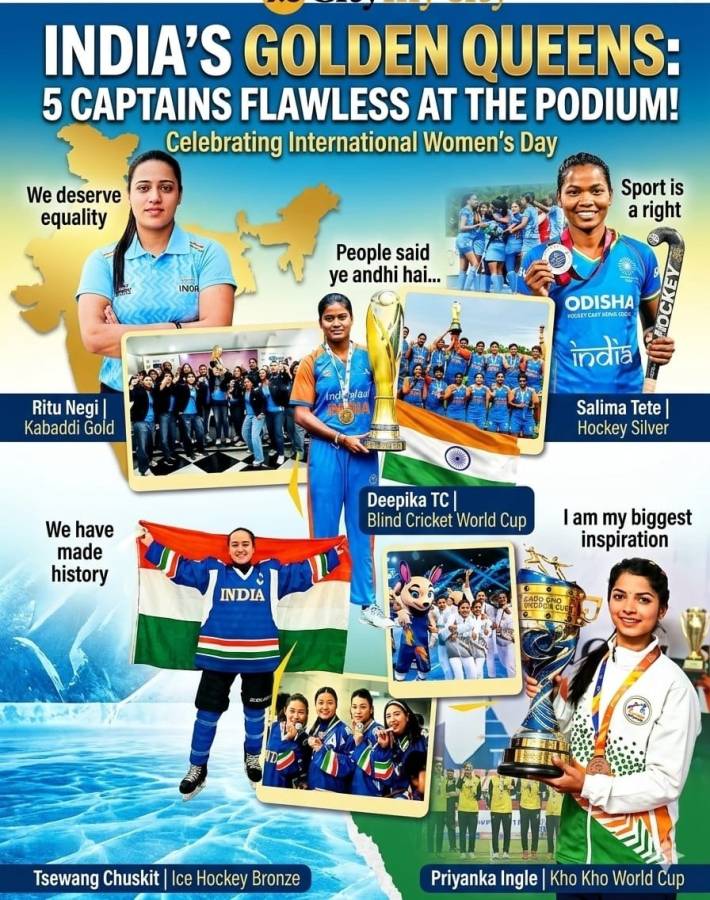

This numerical surge aligns with a broader, quieter revolution. India’s female labour force participation rate has jumped from a stagnant 23.3% in FY18 to a more spirited 41.7% in FY24. This change didn’t emerge from corporate boardrooms or ivory towers but from rural resilience. Whether stitching garments, harvesting crops, selling pickles on WhatsApp, coding in second-tier cities, or serving in administrative services, the military, and defence—Indian women are reshaping the contours of labour and ownership.

Their footprints are now visible in places where they were once absent. As of November 2024, women held 27.7 million demat accounts—up from just 6.6 million three years ago. Over 301 million Jan Dhan accounts belong to women. Under the PM Mudra Yojana, which provides micro-credit to entrepreneurs, women constitute over 68% of borrowers. These are not stray data points; they form a deliberate arc—a movement from marginality to mobility.

That arc reveals a critical insight: the state, once viewed as a patron or patriarch, is evolving into an enabler. Government schemes increasingly target women directly—maternity benefits, LPG subsidies, housing loans, and now digital IDs and PANs. Welfare, once filtered through male gatekeepers, is reaching female hands. With it, a new kind of agency is taking root—not confrontational, but confident; not angry, but unyielding.

Compare this with the period from FY19 to FY23, when women were outnumbered in PAN issuance. Then, even as awareness grew, access remained limited. Now, women are leading the race—not because men have retreated, but because women have surged ahead. The difference is telling.

This ascent is not merely economic—it is psychological. It chips away at centuries of internalised dependence. In the figure of a woman tapping her UPI PIN, opening a mutual fund account, or contesting a GST registration denial, we witness the emergence of a new archetype: the economically assertive Indian woman.

In the image of women boarding a metro train—bags in hand, purpose in step—lies a metaphor for a new India. This is no longer about inclusion as charity. It is about entry by right. It is about dignity measured not by dowry, but by dividend.

Yet, there is still distance to travel. Numbers can open doors, but they don’t guarantee power behind them. Wage gaps persist, glass ceilings endure, and unpaid care work remains invisibly dominant. But for the first time, it seems the Indian woman is not merely joining the economy—she is beginning to define it.

The PAN, then, is not just a document. It is a declaration. A woman with a PAN is not just counted—she is contributing.