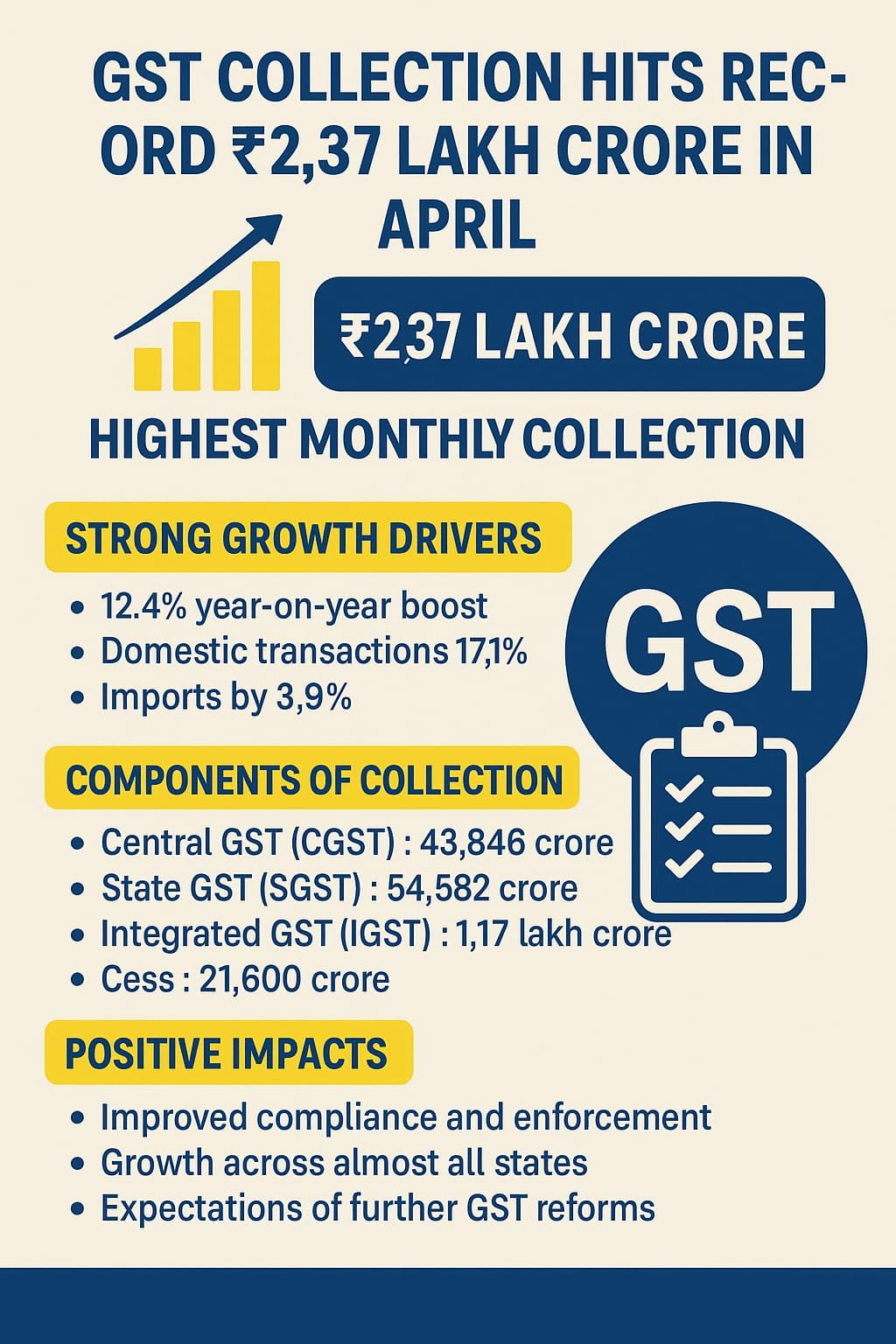

India’s economic engine picked up momentum in April 2025, recording a record-breaking ₹2.37 lakh crore in Goods and Services Tax (GST) collections. This historic figure not only underscores strong business activity across sectors but also signals growing trust in the GST system and increasing taxpayer compliance. It’s the highest monthly GST collection since the indirect tax regime was introduced in 2017, outpacing the previous record of ₹2.12 lakh crore set just a year ago in April 2024.

The growth isn’t a seasonal quirk. While April often sees elevated numbers due to end-of-financial-year settlements, this spike reflects broader structural improvements. Domestic transactions rose by 17.1%, and imports contributed an additional 3.9% growth. Together, they fuelled the steep 12.4% rise over last year’s tally.

The GST revenue distribution reveals the strength of the collection engine: ₹43,846 crore from Central GST (CGST), ₹54,582 crore from State GST (SGST), ₹1.17 lakh crore from Integrated GST (IGST) — including ₹39,763 crore from imports — and ₹21,600 crore from cess, with ₹1,015 crore of that from imports. These numbers show that both domestic consumption and cross-border trade have remained resilient in the face of global uncertainties.

Compliance, Technology, and States Drive the Surge

This jump in collections is not a lucky accident—it’s the result of years of policy groundwork and technological transformation. The GST system has become more transparent, digitized, and interconnected. In April, over 10.4 crore e-way bills were generated, marking an 8% increase from the previous month. This surge indicates a rapid flow of goods across the country and a robust supply chain ecosystem.

Finance Secretary T.V. Somanathan credited this landmark achievement to better enforcement and rising taxpayer discipline. “The collections reflect not just economic activity but also deeper compliance and technology-led reforms,” he stated. With real-time invoice tracking, AI-based red flags for fraud, and automated matching of returns, the system is becoming harder to game and easier to follow.

A key feature of this month’s performance is the widespread participation from almost all states. Industrial states like Maharashtra, Tamil Nadu, Gujarat, and Karnataka saw particularly strong performances, but even states with more service- or agriculture-based economies—like Uttar Pradesh and West Bengal—showed healthy growth. The Centre released ₹50,307 crore to states from the IGST pool, bringing their total share for the month to ₹70,701 crore, while the Centre retained ₹68,046 crore.

This suggests that the GST regime is not only maturing—it’s becoming more inclusive and evenly distributed.

A Fiscal Foundation for India’s Growth Journey

Business leaders and analysts have responded positively to the April numbers, viewing them as signs of both macroeconomic stability and policy effectiveness. Vinay Agarwal, CFO of a consumer goods major, said, “Strong GST numbers give companies the confidence to plan for expansion and investments. Predictability in tax flows means better budgeting and long-term clarity.”

Looking ahead, the GST Council is expected to consider reforms to keep the momentum going. Key areas of focus include rationalizing the multiple GST slabs, simplifying return filing procedures, and automating refund and dispute resolution mechanisms to make compliance even more seamless.

April’s numbers also hold broader fiscal implications. Higher collections can fund critical infrastructure, education, and health initiatives without resorting to aggressive borrowing. In other words, a stronger GST regime lays the financial groundwork for India’s ambition to become a $5 trillion economy.

In conclusion, the ₹2.37 lakh crore GST milestone is more than a revenue figure. It is a reflection of India’s economic maturity, digital tax enforcement, and the collaborative spirit between the Centre and states. If this trend continues, GST won’t just be a tax—it’ll be the backbone of India’s economic future.